What is the EU VAT Information Exchange System (VIES)?

Mini series: All about the VAT ID – Part 3

In this multi-part series of articles, we would like to introduce you to what a Value Added Tax ID (VAT ID) is. In addition, we would like to cover interesting topics worth knowing about the topic of USt-ID and shed some light on the subject.

We hope you enjoy reading!

The EU VAT Information Exchange System (VIES)

To ensure the flow of data held in each Member State across internal borders, an electronic VAT Information Exchange System (VIES) has been introduced through which businesses can confirm the validity of their business partners’ VAT numbers and

Tax administrations can monitor the flow of intra-Community trade and check for any irregularities.

The Central Liaison Office

The body responsible for VAT control of intra-Community trade in each Member State, the central liaison office, has direct access through VIES to the databases containing the VAT registrations of other Member States.

You may also be interested in:

VAT treatment of removal services provided to entrepreneurs

Sales tax treatment of removal services to entrepreneurs In terms of sales tax, it is a matter of removal services and transportation services. Transportation services are other services under Section 3(9) of the Turnove...

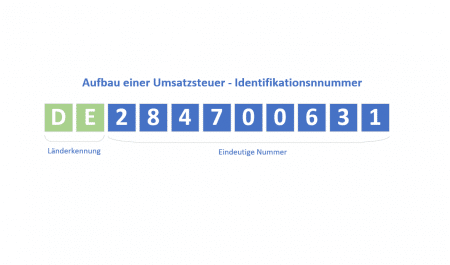

The value added tax identification number (VAT ID No.)

Mini series: All about the VAT ID number – Part 4. In this multi-part series of articles, we would like to introduce you to what a VAT ID (USt-ID) is. In addition, we would like to cover interesting and worth......

Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 5

In this multi-part series of articles, we would like to present to you how the tax authorities are commenting on the changes from 01.01.2020 as part of the so-called “quick fixes”. The principles apply to all...

Fully electronic qualified confirmation for verification of VAT ID

Quick Fixes 2020 Since the 2020 VAT Quick Fixes, the verification of the VAT identification number (VAT ID) is of key importance. In particular, in order to claim tax exemption, it is imperative for businesses to verify ...

Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 6

In this multi-part series of articles, we would like to present how the tax authorities comment on the changes from 01.01.2020 in the context of the so-called “quick fixes”. The principles apply to all delive...

Why the VAT ID check is important for intra-Community deliveries – an example

Mini series: All about the VAT ID number – part 12. In this multi-part series of articles, we would like to introduce you to what a VAT ID (USt-ID) is. In addition, we would like to cover interesting and worth......