Why is the VAT number important for companies?

Mini series: All about the VAT ID – Part 2

In this multi-part series of articles, we would like to introduce you to what a Value Added Tax ID (VAT ID) is. In addition, we would like to cover interesting topics worth knowing about the topic of USt-ID and shed some light on the subject.

We hope you enjoy reading!

Important for European trade

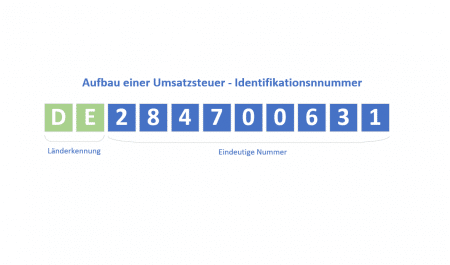

The VAT ID number is a unique identification number for businesses. The VAT ID No. is important for trade in goods and services in the European Union (EU). For companies trading within the EU with each other, it represents a unique identifier.

The beginnings of the VAT identification number

The beginnings of the VAT identification number date back to 1993. On January 1, 1993, the single European market came into being with the abolition of border controls. At the same time, a new VAT control system was established for intra-Community trade. The aim of the VAT control system was to reduce the administrative burden on businesses, which had been high until then. The creation of the single market eliminated about 60 million customs documents.

Under these new VAT rules, intra-Community supplies were exempt from VAT under certain conditions. A supply to another EU country is exempt from VAT (exempt intra-Community supply) if the subject of the supply enters another EU country and the supply is made to an entrepreneur in the VAT sense for the entrepreneur’s business.

Exemption for certain supplies

To ensure the flow of data held in each Member State across internal borders, an electronic VAT Information Exchange System (VIES) has been introduced through which businesses can confirm the validity of their business partners’ VAT numbers and

Tax administrations can monitor the flow of intra-Community trade and check for any irregularities.

The body responsible for VAT control of intra-Community trade in each Member State, the central liaison office, has direct access through VIES to the databases containing the VAT registrations of other Member States.